Highlights:

- No health questions or underwriting

- No pre-existing condition exclusions*

- Maternity is covered same as any other illness

- Works great with Health Savings Account (HSA) qualified plans

- Indemnity benefits are paid regardless of any other health insurance plan

- Available to groups large and small (10 eligible and 5 enrolled)

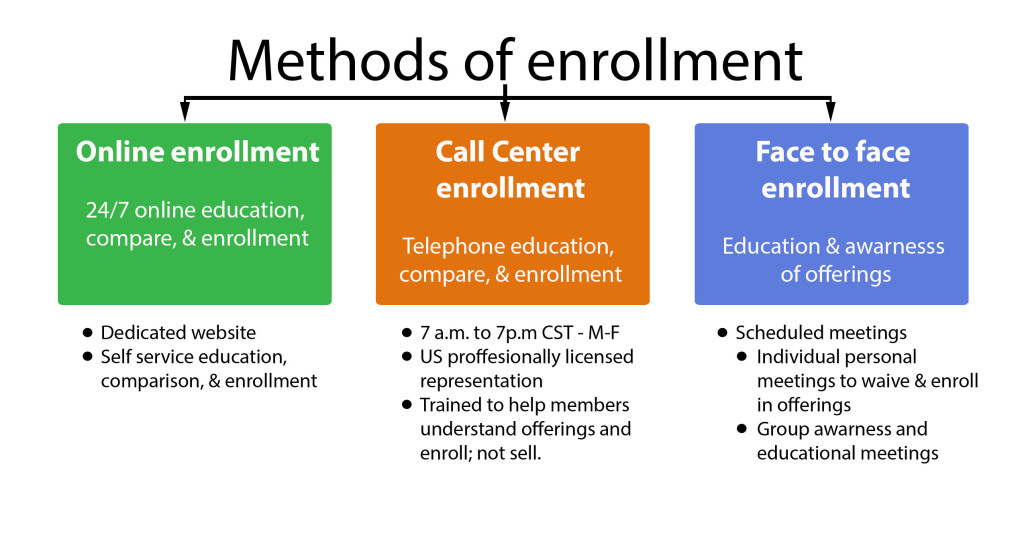

- Simple online, call-center, or face to face enrollment

- Census enrollment for 100% employer paid groups

*6/6 pre-existing condition applicable ONLY to Hospital R&B/ICU/CCU, Surgery and Anesthesia for employees NOT enrolled during an open enrollment period (Late enrollee)

Why?

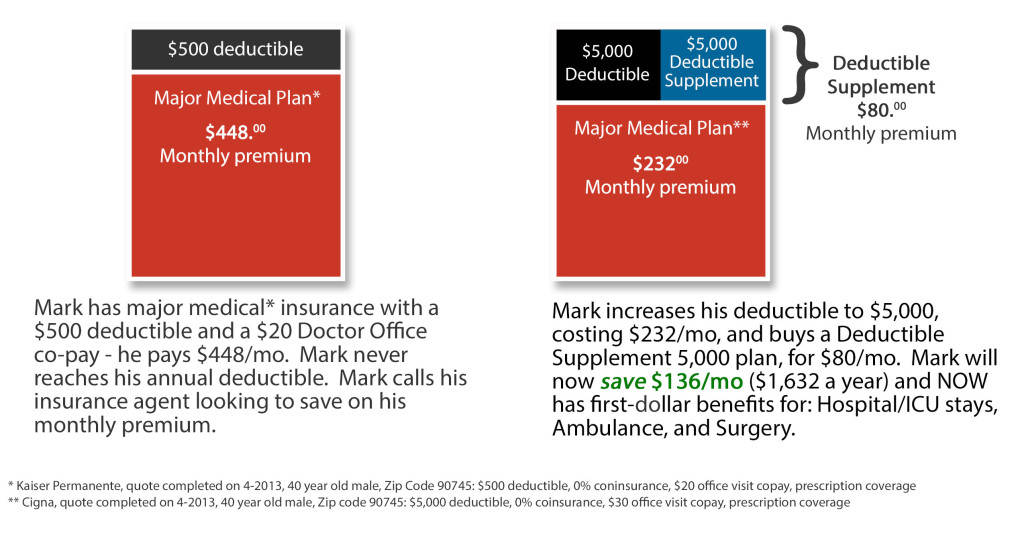

Health insurance premiums are increasing year after year; many employers have consistently increased the deductibles and out-of-pocket costs in order to keep the health insurance plans manageable. High deductible health plans and Health Savings Accounts are a common benefit offering in today’s marketplace. Now, your employees have the option of minimizing their high out-of-pocket costs.

What?

The Deductible Supplement Plan is available to help employees manage their increased out-of-pocket exposure. It provides employees supplemental indemnity benefits for sickness and accident situations. Benefits are lump sum indemnity benefits which are paid directly to the employee regardless of any other health insurance plans. Premiums as low as $10 bi-weekly.

How?

Sometimes having two plans is better than one. See the below sample case study to see how simple this can work.

Schedule of Benefits:

Indemnity lump sum sickness and accident benefits are paid directly to the employee based on the amount of coverage listed in the schedule of benefits. Benefits are payable regardless of any other health insurance plan.

Plans |

Value |

Bronze |

Silver |

Gold |

Platinum |

|

Designed for Out-Of-Pocket (OOP) plans* |

$500 – $1,000 OOP |

$1,500 – $2,000 OOP |

$2,500 – $3,500 OOP |

$4,000 – $6,000 OOP |

$6,000 – $10,000 OOP |

|

Initial Hospital or ICU confinement |

$400 |

$750 |

$1,000 |

$2,000 |

$2,000 |

|

Additional Hospital or ICU Benefits |

$200/day Days 2-4 |

$250/day Days 2-4 |

$500/day Days 2-4 |

$1,000/day Days 2-4 |

$2,000/day Days 2-5 |

|

Bonus Benefits Below: |

One visit per covered person per year |

One visit per covered person per year |

One visit per covered person per year |

One visit per covered person per year |

One visit per covered person per year |

|

Surgery In or Out Patient |

$250 |

$250 |

$250 |

$250 |

$250 |

|

Anesthesia Benefit |

$50 |

$50 |

$50 |

$50 |

$50 |

|

Ambulance Ground or Air |

$250 |

$250 |

$250 |

$250 |

$250 |

|

Maternity Benefits |

Yes |

Yes |

Yes |

Yes |

Yes |

Hospitalization / Intensive Care Unit (ICU):

- First Day Admission Benefit: paid when a covered person is first admitted to a hospital per Plan Year.

- Additional Hospitalization Benefit: paid for additional days of hospital confinements based on plan selected.

Surgery Benefit: A $250 benefit paid for one inpatient or outpatient surgery per covered person per Plan Year. In addition if anesthesia is required for the surgery, you will receive a $50 Anesthesia benefit. Ambulance: A $250 benefit is paid for ground or air ambulance transportation to a hospital for either sickness or an accident Maternity: Benefits are payable same as any other illness.

*This is to be used as a guide to determine which plan will work best for you and your employees. Your combined deductible and co-insurance limits of your health plan(s) determine your Out-Of-Pocket costs. Underwritten by the United States Fire Insurance Company, rated A (Excellent) by AM Best (2014 Edition).

Administration is provided by InsuranceTPA.com. Pre-existing Condition Limitation for Late enrollees: 6/6 pre-existing condition applicable ONLY to Hospital R&B/ICU/CCU, Surgery and Anesthesia for employees NOT enrolled during an open enrollment period (Late enrollee)

Enrollment:

Employees can view benefits 24/7 online and enroll in seconds. If they prefer to speak to a professional; availability of licensed insurance representatives which will help them understand the offering and not sell them insurance.

Interested in learning more about this product? Complete the simple form below and we’ll be in touch.

[Contact_Form_Builder id=”6″]